ev charger tax credit california

Over 9000 in California EV rebates and EV tax credits available. In some states an EV charger can be eligible for incentives.

Ev Charging Stations On Highways Dot Approves 50 States Plans

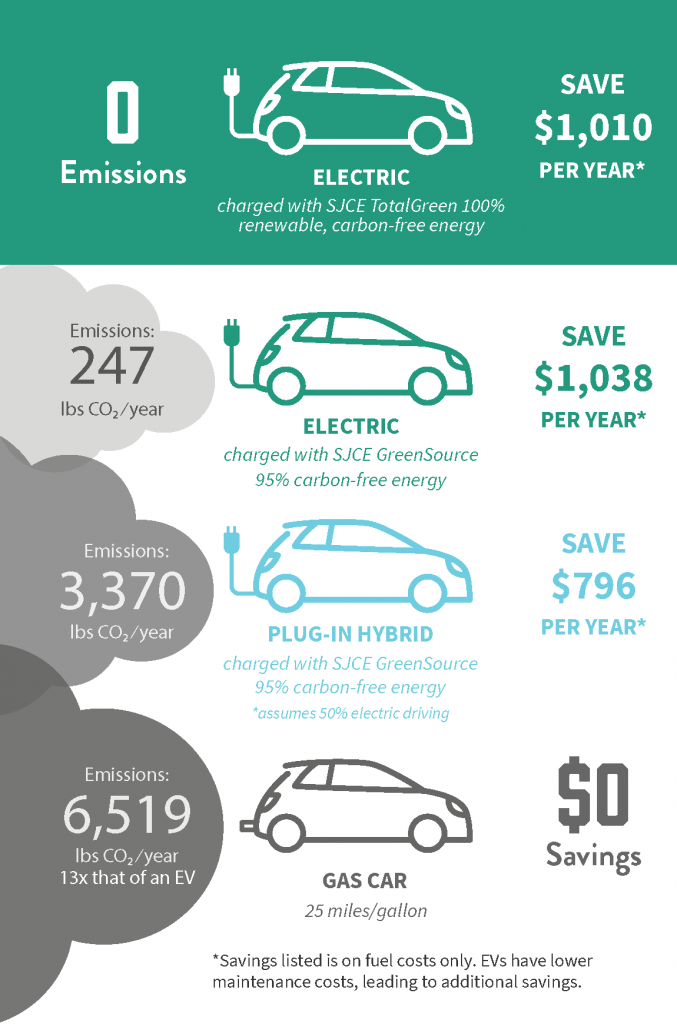

Southern California Edisons Pre-Owned EV Rebate Program offers customer a 1000 rebate for the purchase or.

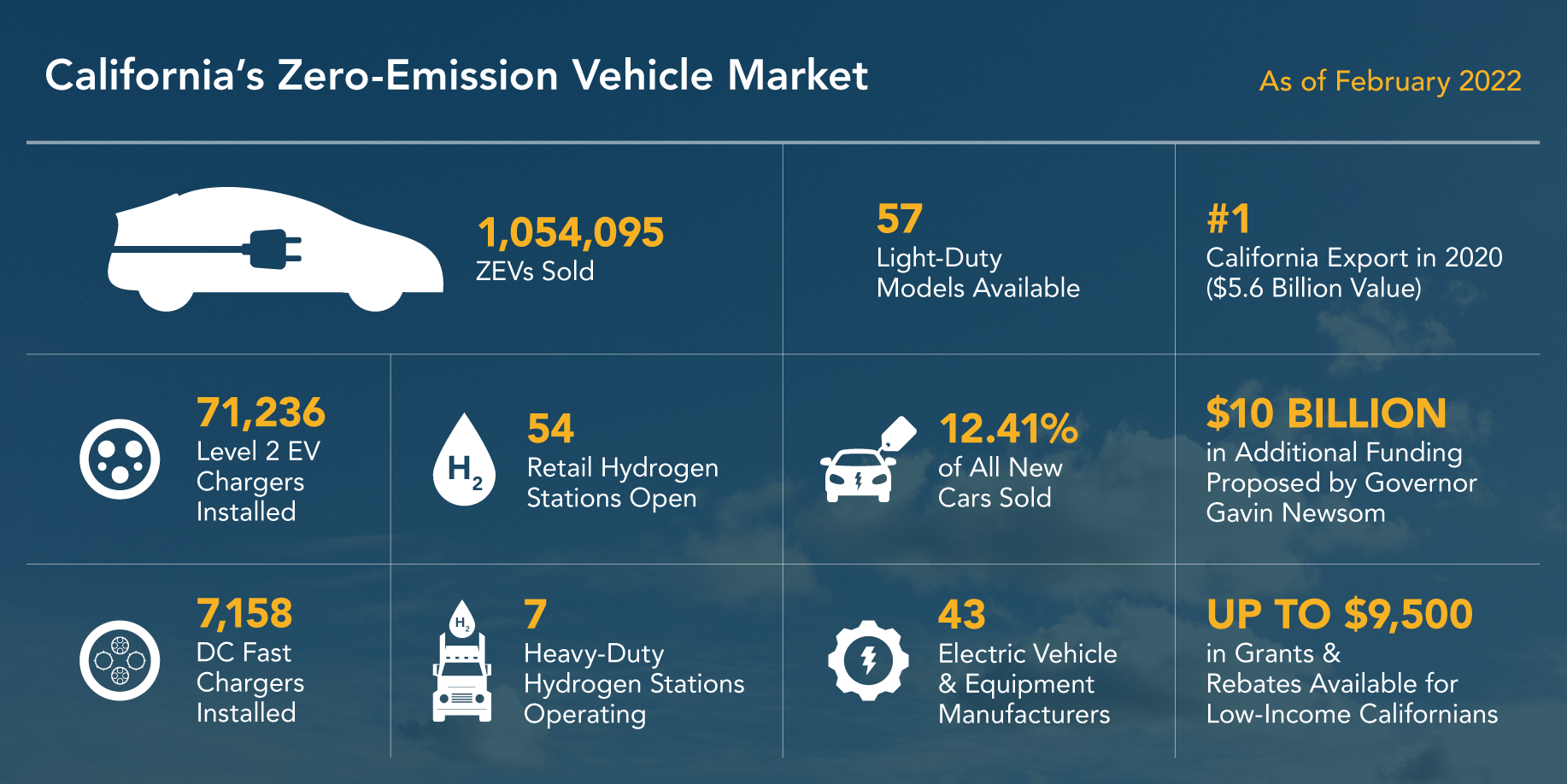

. A tax deduction for the highest earners in California will save you around 50 cents on the dollar when combining federal and state income taxes. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. As of December 2019 California has 22233 electric vehicle charging outlets including 3355 direct current fast chargers at over 5674 public stations throughout.

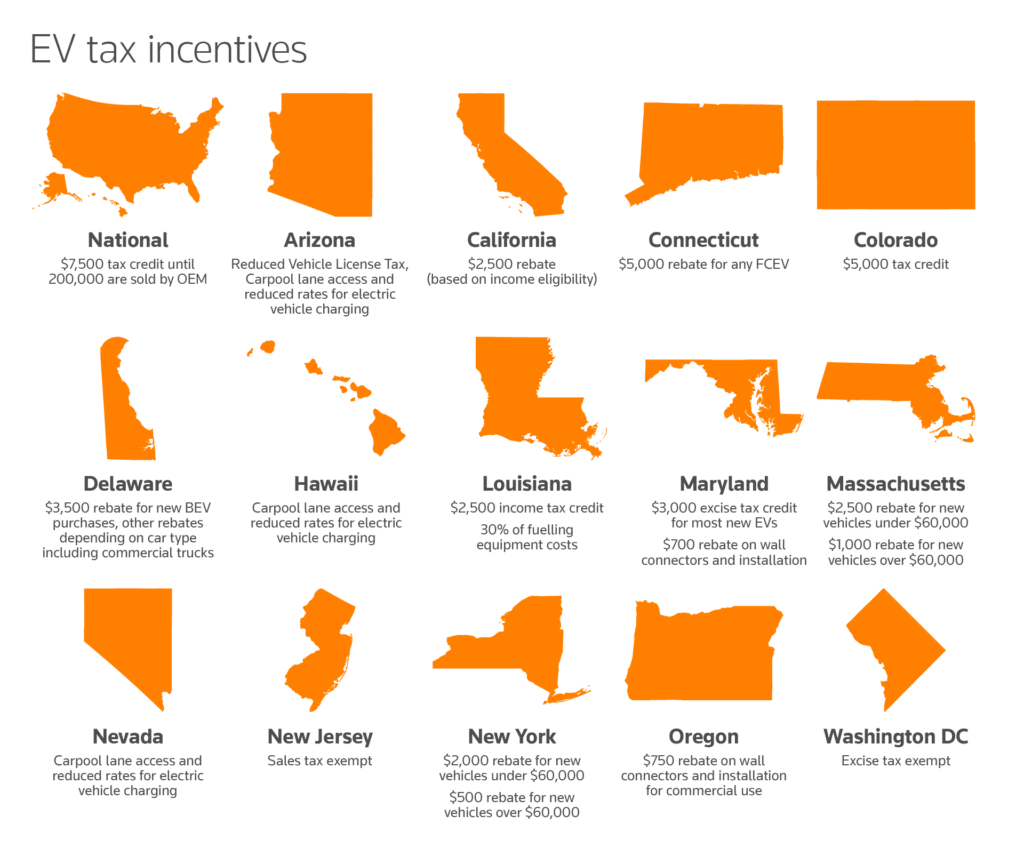

The residential EV charger tax credit system applies to the cost of buying and installing an EV charging station. Reduce EV charging equipment and installation costs with incentive and rebate programs available in California before funding runs out. Reduced Vehicle License Tax and carpool lane access.

VEC offers a 250 bill credit to members who purchase a new or used plug-in hybrid electric vehicle PHEV and a 500 bill credit to members who purchase a new or used all-electric. Up to 1000 state tax credit. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California.

In addition to local incentives the federal rebate for electric cars applies to all fifty states. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of this writing. Electric Vehicle and Fuel Cell Electric Vehicle FCEV Tax Credit Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000.

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs expired on December 31. Local and Utility Incentives. Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric cars.

Compare electric cars maximize EV incentives find the best EV rate. Theres an EV for Everyone. Under the Sonoma Clean Power incentive those who qualify will pay for half of the cost of an EV charger plus installation costs and a 50 shipping fee and will then be credited.

Customers who live in a handful of states with their own EV incentives can also subtract a. Depending on the county in. EV Charging in California.

EV rebates and tax credits from your state remain a steady constant. This federal EV tax credit can save customers about 7500 on their EV purchase. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended through 12312032.

Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or. Solar and Energy Storage. State incentives apply to a wider range of EVs and PHEVs plug-in hybrids and do not have the.

The tax credit works by offering a tax credit of 30 of all. Note that the federal EV tax credit amount is affected by your tax liability. This tax credit covers 30 up to 1000 per unit of the cost for.

If you lease an EV from the manufacturer rather than the leasing company you will receive the tax credit.

How Do Electric Car Tax Credits Work Credit Karma

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

Federal Tax Credit For Ev Charging Stations Installation Extended

California S Ev Charging Network Could Use A Jolt A Trip Down I 5 Shows Los Angeles Times

California To Benefit From New Federal Funding For Electric Vehicle Charging Stations Cbs8 Com

California Targets 384m To Fill Gaps In Electric Vehicle Charging Infrastructure Greentech Media

Which Electric Vehicles Qualify For The 7 500 Tax Credit Newsnation

California Leads The Nation S Zev Market Surpassing 1 Million Electric Vehicles Sold California Governor

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Federal Tax Credit For Ev Charging Stations Installation Extended

Electric Vehicles San Jose Clean Energy

Ev Tax Credit 2022 Updates Shared Economy Tax

How To Get Money For Evs And Charging Chargepoint

Electric Day California Phases Out Sales Of Gas Cars Calmatters

Every Electric Vehicle Tax Credit Rebate Available By State

New Senate Climate Bill Contains Ev Tax Incentives Marketplace

Why The New Ev Tax Credit Would Be A Game Changer For Electric Cars Grist